Instant noodles or last night’s leftovers? What for? There’s no doubt that foodtech startups have transformed the way urban India eats. All you need to do is whip out your phone and order what you like.

Foodtech startups were built on the foundation that roti, kapda aur makaan could never go out of demand, but over time many of them faced an early death. Only the big two – Swiggy and Zomato – survived. And if you look at it, the game is of the big players. There is a market for foodtech, but now the money is being pumped deeply into one segment.

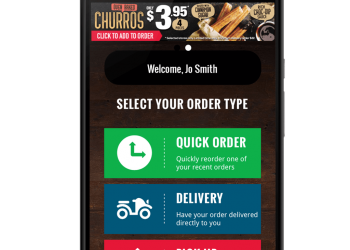

Online food businesses today are essentially focused on delivery, online kitchen, and a combination of both.

Where many Investors and entrepreneurs burnt their fingers and realized that food was a tough business, a new upcoming foodtech startup is trying hard to compete with these two successfully food tech companies with a guarantee to gain success and compete with them-FoodChow.

The question arises what helped the two players survived? What is that they did differently? And how will this upcoming startup compete them and stand a place equal to them?

When Swiggy first started operations, its main proposition was to ensure that they delivered food from not only high-end restaurants but also pocket-friendly joints and everything in between. Meanwhile, Zomato, initially called Foodiebay, is one of the oldest surviving food businesses in India. In 2015, Zomato raised its funding. It was in 2015 that Zomato ventured into the food-delivery space.

Swiggy had the first mover advantage and was miles ahead and Zomato had successfully survived.

Today, apart from the restaurant chains and bigger players, Swiggy also works with small restaurant owners, who form a big part of the unorganized restaurant business. For many small restaurants, Swiggy is the primary route through which orders flow in. Zomato, on the other hand, crossed the three million deliveries a month mark. This is in just two years since launching the meal delivery service. It has 25,000 restaurants on its platform in India, including 7,500 that are exclusively available only on Zomato.

Both Zomato and Swiggy have also launched the cloud kitchen vertical, where the company provides the space and sets up a physical kitchen for participating restaurants that just have to get the food made and fulfill deliveries.

Interestingly, while Zomato and Swiggy survived, FoodChow launched operations in India. FoodChow has been pushing aggressively into the Indian market by acquiring delivery boys and adding more restaurant partners with each passing week.

Being late in the game, it isn’t the contenders one can ignore. Swiggy and Zomato have a bigger game. They have seen the market and have the advantage of understanding the space. Here is where FoodChow is lacking and promises to match the big gamers in upcoming years.

In a business that generally has a low basket size, has perishable goods, and is done real time, it becomes very important that the cost is significantly low with compared to other foodtech companies. And FoodChow is focusing on that, by connecting it directly to the producers. That is, it lets you interact with the restaurant directly and cuts off the commission of middlemen and a third-party application and except for this, providing with the same facilities as offered by Zomato and Swiggy.

The Indian foodtech market is big enough to accommodate many players, now let’s see who maintains their positions and who drags other down.